Free Beginner Options Trading Course

Learn how to profit with options in this free beginner’s course. Discover how calls and puts work, why traders use options, and how to manage risk while building simple strategies.

Designed for beginners, this course breaks down complex concepts with real-world examples and clear explanations so you can start trading options with confidence.

What Will You Learn in This Options Trading Course?

14 Options Trading Lessons

What Our Students Are Saying...

wooooow

wow wow wow

Very detailed explanation of these confusing factors

Loving it so far

Very Clear

The explanation clarifies the mist around option

The Video Style Makes it Clear

I’ve tried other option trading courses and this one is by far the best, the video style makes it very clear and easier to understand how options work.

This makes it very clear

Options are generally confusing, this course greatly simplify them.

Now I get it!

Hi. I am loving the videos as they are clarifying a lot of concepts to me.

Looking forward to what comes next.

Great explanation and easy to follow!

Great

Very well explained.

Very understandable!

This course makes it easy to understand options and how they work.

Confused at first, just rewatch

Thank you for the videos Chris, options are confusing, but if I rewatch I can get it!

Love this Course

It’s Really helpful. Short and crispy

Great video

Is there anywhere IV can be plotted over time so that you can see how it is trending?

This site is awesome.

Cant wait to work through all of the modules.

I like the quizes

Perfect, need Practice

Excellent

Excellent, New learning… in simple way,

I like the approach

I really like the way you explain things in a clear and logical way without jumping ahead of what you have presented.

Muy clara la explicación

Muy clara la explicación

You make it easy

Nice tutorial, keep it up

I see...

Unlimited Profit for Call buy option and limited loss of maximum amount paid as premium.

Response from #1 Options Strategies Center

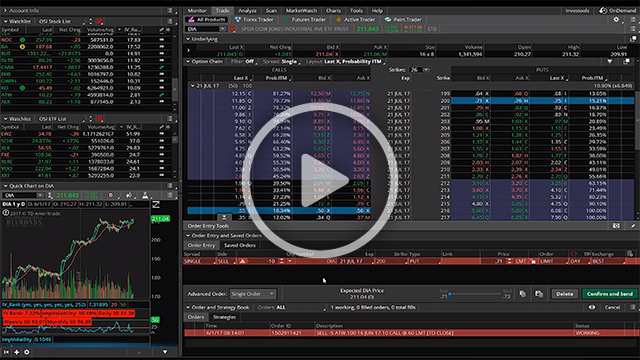

Yes, our IV rank plug-in for thinkorswim will allow you to plot IV rank. This can be found under the trading tools tab.

It's Making Sense Now

More Reward = More Difficult because More Profit= Less Success.

So, OTM Call Buy may gives return if Price goes up but if it goes against our direction, unlimited loss will ready to welcome.

Start Learning Options Now!

This is the highest-rated options trading course available, recognized by users as the number one choice. It delivers clear, practical lessons that make learning options easy, engaging, and effective for beginners.

Special Price

Free

Finding the strongest trading opportunities

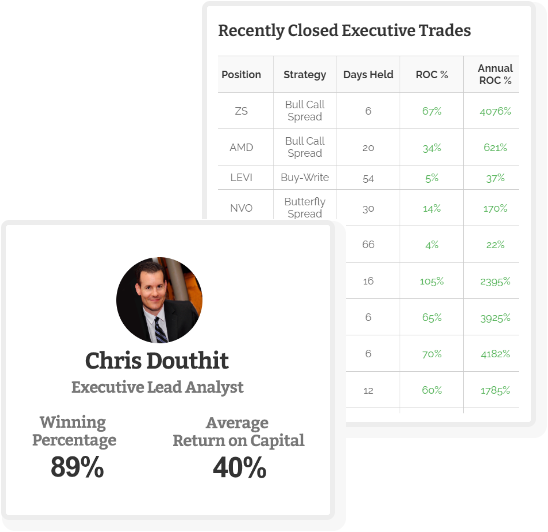

Each week, we carefully analyze hundreds of potential trading setups to identify the strongest opportunities as early as possible. Our goal is to consistently find trades with the highest potential returns for all of our members.

Company

About

Options Trading

Join Us

IF YOU DON’T AGREE WITH (OR CANNOT COMPLY WITH) OUR TERMS OF SERVICE OR POLICIES, THEN YOU MAY NOT USE THE THIS SITE AND MUST EXIT IMMEDIATELY. PLEASE BE ADVISED THAT YOUR CONTINUED USE OF THIS SITE AND INFORMATION WITHIN SHALL INDICATE YOUR CONSENT AND AGREEMENT TO THESE TERMS AND CONDITIONS.

Option Strategies Insider may express or utilize testimonials or descriptions of past performance, but such items are not indicative of future results or performance, or any representation, warranty or guaranty that any result will be obtained by you. These results and performances are NOT TYPICAL, and you should not expect to achieve the same or similar results or performance. Your results may differ materially from those expressed or utilized by Option Strategies insider due to a number of factors.